Zcash casino

This is a shared online sweepstakes promotion among all four U.S. states where BetMGM Casino is live. During the promotional period, opt into the Frosty Fortune Leaderboard. Every $40 wagered on select games will earn 1 leaderboard point https://funny2minutes.com. These games are Jingle Bells Bonanza, Fruit Shop Christmas Edition, Aloha! Christmas, Jingle Spin, and Christmas Morning. The top 100 players with the most points at the end of the promo period will receive Casino Bonus prizes based on their final positions. The total prize pool is $40,000. First place will take home up to a $20,000 in Casino Bonus. Bonus offer dates: December 16 – 22 Rock around the Christmas tree with this promo at BetMGM Casino Michigan

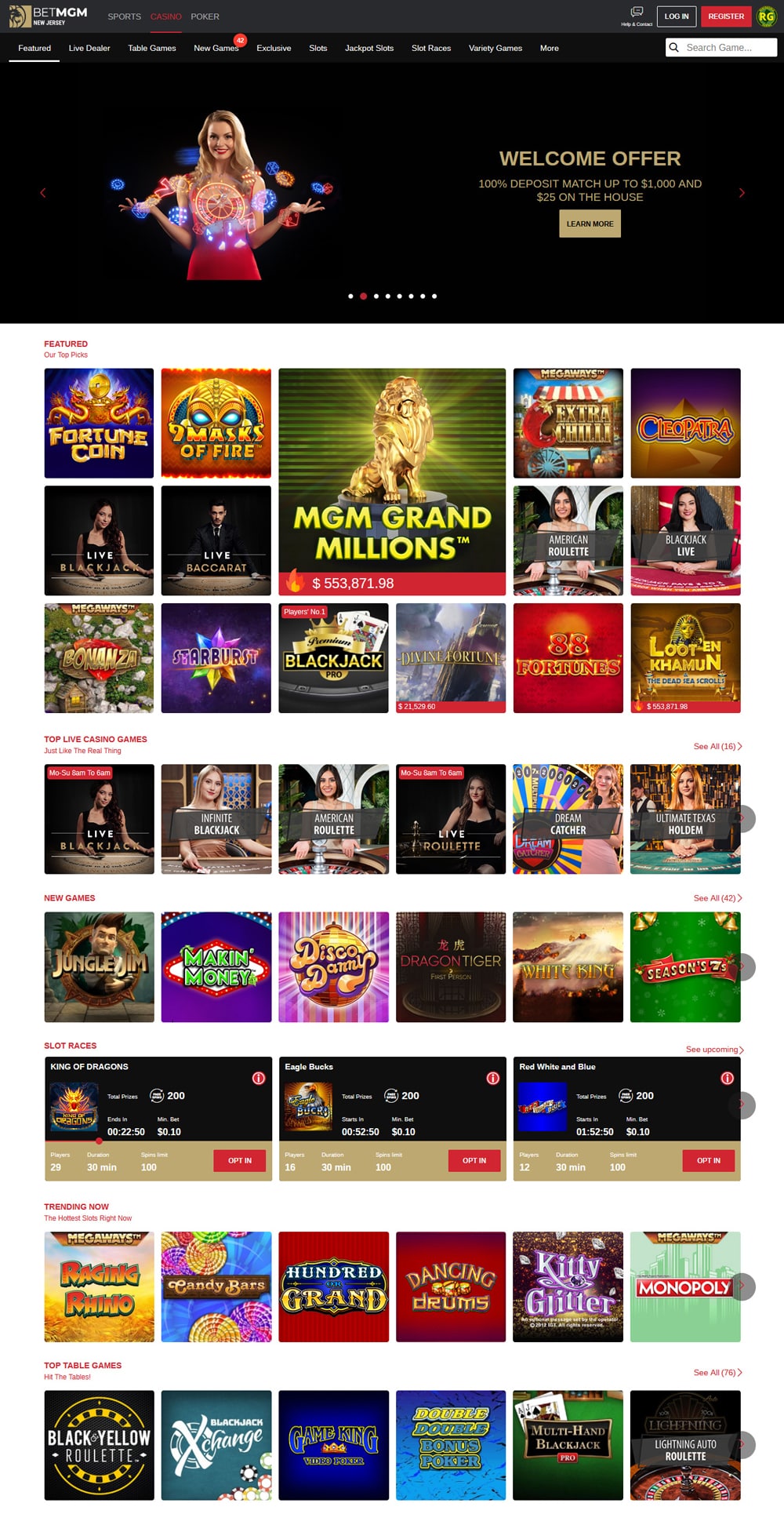

It’s important to note that BetMGM Casino is only legally active and regulated in the following states: New Jersey, Pennsylvania, Michigan, and West Virginia. This means that you must be physically located in one of these states to legally play games online for real money via the BetMGM Casino app and website.

Sign in to your account on participating home game days throughout the season to participate in the Philadelphia 76ers Bank Shot in-game trigger promo. Players receive a $5 Casino Bonus on the Philadelphia 76ers Bank Shot game if the team scores 110 points or more on a home game. Players have one day to use the bonus. Bonus offer dates: November 12, 2024 – April 13, 2025 Dribble up the wins at BetMGM Casino NJ

It’s a win-win combination of the gaming excellence players associate with MGM destinations, together with the convenience of online play. In addition, you get to earn both BetMGM Rewards and MGM Rewards, which you can redeem for online play or use for amenities at the many stunning land-based MGM casinos. It’s the ultimate integrated recreational gambling experience. Keep reading to learn more about the MGM legend and where BetMGM Casino fits in.

Best online casino

Legale online casino’s bieden vaak een breed scala aan bonussen en promoties voor nieuwe en bestaande spelers. Deze bonussen kunnen variëren van welkomstbonussen tot gratis spins en cashback-aanbiedingen. Voor nieuwe spelers zijn welkomstbonussen een van de grootste trekpleisters, en veel casino’s bieden aantrekkelijke deals om nieuwe klanten aan te trekken.

Alle Nederlandse casino’s kunnen worden aangemerkt als iDEAL casino. Dit wil zeggen dat je met iDEAL vanaf je Nederlandse rekening kunt storten om te gokken. Gunstig is vooral dat je nooit te maken krijgt met transactiekosten. Al het geld dat bij een online casino gestort wordt komt dus 100% terecht op je account.

CasinospellenBij OneCasino Nederland vind je zo’n 1.000 verschillende gokkasten en ongeveer 300 verschillende Live Casino spellen. Daaronder vallen vrijwel alleen maar spellen die afkomstig zijn van de grote spelproviders, waaronder Play’n Go, Pragmatic Play, Evolution Gaming en Yggdrasil.

Legale online casino’s bieden vaak een breed scala aan bonussen en promoties voor nieuwe en bestaande spelers. Deze bonussen kunnen variëren van welkomstbonussen tot gratis spins en cashback-aanbiedingen. Voor nieuwe spelers zijn welkomstbonussen een van de grootste trekpleisters, en veel casino’s bieden aantrekkelijke deals om nieuwe klanten aan te trekken.

Alle Nederlandse casino’s kunnen worden aangemerkt als iDEAL casino. Dit wil zeggen dat je met iDEAL vanaf je Nederlandse rekening kunt storten om te gokken. Gunstig is vooral dat je nooit te maken krijgt met transactiekosten. Al het geld dat bij een online casino gestort wordt komt dus 100% terecht op je account.

Bonus

You earn R40 000 per month. You decide to invest R5 000 into a retirement annuity. SARS will not tax you on the R40 000. Instead, you only pay tax on R35 000. The contribution you made to the retirement annuity reduces your taxable income. And you pay less tax.

Retirement annuity contributions are tax deductible in South Africa. That means, you pay less tax when you invest in a retirement annuity. However, are they really worth it for everyone? If you earn R7 500 per month, do you even qualify for any tax deductions? What about if you earn R40 000 per month? What about R100 000?

The deemed cost method allows you to factor in fuel and maintenance costs only if you have paid for them entirely out of your own pocket. If your employer reimburses you for any portion of these expenses, you cannot include that component when calculating your cost per kilometer.

If you are employed and receive a travel allowance from your employer, you are able reduce your taxable income by claiming a tax deduction for the fuel you bought and maintenance costs. This quick “Travel tax deduction calculator” calculator shows you how much you can claim.